457 withdrawal calculator

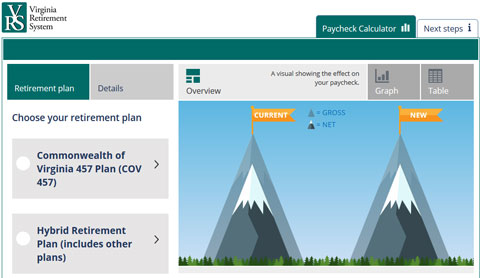

Impact of increasing my 457 Plan contribution. INPRS Systematic Withdrawal Plan for Retirees.

1

How a 457b plan differs from a 401k plan.

. Limits Apply to Two Plans These limits apply to any 403b and 401k accounts a taxpayer might have during the year. What may my 457 Plan be worth. These withdrawal benefits are only applicable if you have completed at least six months.

What is the impact of increasing my 457b contribution. Im self-employed how much can I contribute to a retirement plan. What is the impact of increasing my 457b contribution.

PERF COLA and 13th Checks. Including the amount of the cash withdrawal from your retirement plan. Heres how the 457b plan.

830 am - 930 pm. This included the first RMD which individuals may have delayed from 2019 until April 1 2020. 457b and other defined contribution plans when you turn 72 or retire whichever is later plan permitting.

Contribution limit is the lesser of 100 of employees includable pay or 19500 for 2021 20500 for 2022. Use the Benefit Calculator. If you turned age 70½ before January 1 2020 then your RMD age is 70½.

When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. 401k 403b 457 Plan In the US two of the most popular ways to save for retirement include Employer Matching Programs such as the 401k and their offshoot the 403b nonprofit religious organizations school districts governmental organizations.

Another significant difference between these plan types concerns the application of the additional 10 early withdrawal tax. So we developed a user friendly loan payment calculator which figures it all out for you. Sign On Customer Service.

Open an IRA or roll over a 401k 403b or governmental 457b plan to an IRA. Retirement Benefit Payment Dates. One major difference is that currently 457 plans are designed for public sector employees and 401k plans are designed for private sector employees.

Offered by state and local governments to their workers. If you left your employer in or after the year in which you turned 55 you are not. What may my 403b Plan be worth.

What may my 403b Plan be worth. Or governmental 457b plan to an IRA 1-877-493-4727 Mon Fri. May be offered by any employer.

The regular 10 early. The 457b retirement plan offers many advantages to government workers including tax-deferred growth of their savings but these plans do come with some drawbacks. These streams of retirement income may include funds from 401k 403b and 457 plans as well as traditional and Roth IRAs annuities and other investments stocksbonds and savings.

You may have to devote some time to tracking your contributions to your 401k and 403b plans to make sure that you dont contribute more than the amount allowed if you have two or more jobs or if you switch jobs in the middle of the year. Salary deferral limit was 19500 for 2021 20500 for 2022. Normally you will start getting a monthly pension once you turn 58 years.

Early Withdrawal Calculator. While there are similarities between a 457b and a 401k there are also key differences to keep in mind. 401ks vary from company to company but many employers offer a matching contribution up to a certain percentage of.

No early withdrawal penalty. Use this calculator to determine how long those funds will last given regular withdrawals. The Motley Fool provides leading insight and analysis about stocks helping investors stay informed.

Comparing mortgage terms ie. Impact of early withdrawal from my 401k. What is the impact of early withdrawal from my 401k.

What is the impact of early withdrawal from my. Both plans allow you to contribute money towards retirement on a tax-deferred basis. The following COVID information was for 2020 Returns.

Investment Fund Fact Sheets. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash. Also if your total service has crossed 9 years and 6 months you will not be eligible for withdrawal as now you become eligible for EPS.

Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k Skip to content. Disability. 457b Plans 401k Plans.

Apply for State Jobs. Use our free retirement withdrawal calculator to evaluate your plan. Sign-Up For Our E-Newsletter.

As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. What may my 403b. 15 20 30 year.

Vrs Contributions

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457 Vs Roth Ira What You Should Know 2022

457 Contribution Limits For 2022 Kiplinger

457

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

A Guide To 457 B Retirement Plans Smartasset

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

457 Retirement Plans Their One Big Advantage Over Iras Money

457 Plan Types Of 457 Plan Advantages And Disadvantages

Can I Max Out My 401k And 457 Here S How It Works

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

403 B Vs 457 B What S The Difference Smartasset

457 Deferred Compensation Plan

457 Retirement Plan Explained Youtube